We have seen so far that age, gender and marital

status have a significant impact on the risk aversion of the CEO. This however,

is not where this blog stops. We continue to look for more parameters that have

a significant impact on the CEO’s capital structure decisions.

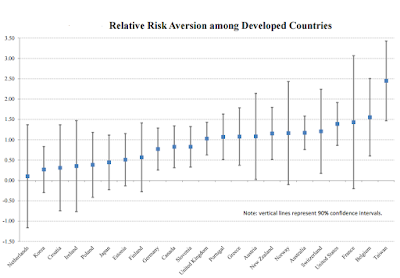

The paper of N.Gandelman and R. Hernández-Murillowe (2014) estimated the coefficient of

relative risk aversion for a broad range of countries, including 52 developing

countries. The estimates showed that on average developing countries are more

risk averse than developed countries. The results of the paper of N. Gandelman

and R. Hernández-Murillowe stress the importance to consider different

parameterizations for developing and developed countries when constructing

models about the risk aversion of CEO’s.

|

| Click on the graph to see further details |

In addition, the

paper of Y. Pan, S. Siegel and T. Y. Wang (2014) examined and exposed a

significant association between culturally (heritage) transmitted risk

preferences of CEOs and corporate investments. Similarly, B. Frijns, A. Gilbert, T.Lehnert and A. Tourani-Rad showed in 2011 that CEOs of firms located in

countries with higher levels of risk aversion, on average go for a less risky

capital structure and policy by diversifying more, doing less takeover

activities and restraining the gearing ratio.

The relevant paper listed above will help us better understand the dynamics behind the relative risk aversion of a CEO in a company. A profound insight in the thoughts and feelings towards risk by the CEO is essential to obtain a sufficient optimal set of parameters for the regression of the CEO's characteristics on the capital structure.